-

The Group wins prime waterfront Repulse Bay site for HK$1.18 billion, sets record for land sold through government tender

The Group wins prime waterfront Repulse Bay site for HK$1.18 billion, sets record for land sold through government tender -

The Group success acquisition property of Loong Fung Terrace on Jardine’s Lookout for total acquisition cost of HK$627 million

The Group success acquisition property of Loong Fung Terrace on Jardine’s Lookout for total acquisition cost of HK$627 million

-

The Group and its Joint Venture Partners pleased to announce the sales launch of “Grand Victoria維港匯”, West Kowloon Waterfront residential development (NKIL 6549)

The Group and its Joint Venture Partners pleased to announce the sales launch of “Grand Victoria維港匯”, West Kowloon Waterfront residential development (NKIL 6549)

-

.jpg) The Group acquired majority area of 50 Wellington Street in Central, Hong Kong, at HK$780 million.

The Group acquired majority area of 50 Wellington Street in Central, Hong Kong, at HK$780 million. -

The Group disposed of John Sinclair House in Edinburgh, Scotland, United Kingdom.

The Group disposed of John Sinclair House in Edinburgh, Scotland, United Kingdom.

-

The Group issued Notes with principal amount of USD150,000,000 with 5-year maturity. The Notes Issue were well-received by the market substantial demands from investors in Hong Kong, Singapore and Europe.

-

The Group's consortium won the tender for the West Kowloon Waterfront residential site at record breaking price of HK$17.3 billion.

The Group's consortium won the tender for the West Kowloon Waterfront residential site at record breaking price of HK$17.3 billion. -

-20180213110336.jpg) The Group acquired Bank of Scotland’s Headquarter in London at approximately HK$2.6 billion.

The Group acquired Bank of Scotland’s Headquarter in London at approximately HK$2.6 billion. -

.jpg) Mr. Lambert Lu was appointed as Chief Executive of the Group.

Mr. Lambert Lu was appointed as Chief Executive of the Group. -

The Group unlocked value to shareholders through distribution of special cash dividend and the United Kingdom listed subsidiary (Asian Growth Properties Limited) has cancelled its admission to trading and dissolved accordingly.

-

.jpg) The Group acquired properties in Shouson Hill, Hong Kong at approximately HK$1.528 billion.

The Group acquired properties in Shouson Hill, Hong Kong at approximately HK$1.528 billion. -

The Group first issued Notes with principal amount of USD 200,000,000 with 3-year maturity. The Notes issued drawn overwhelming market responses with nearly 8 times of oversubscription (with nearly USD 1.6 billion in orders).

-

SEA Group celebrated the 60th anniversary of its establishment.

SEA Group celebrated the 60th anniversary of its establishment. -

The Group acquired the Headquarter of United Kingdom Prudential Regulation Authority at approximately HK$1.5 billion.

The Group acquired the Headquarter of United Kingdom Prudential Regulation Authority at approximately HK$1.5 billion. -

The Group disposed of the China property development project, Chengdu Nova City, at a consideration of HK$0.89 billion.

The Group disposed of the China property development project, Chengdu Nova City, at a consideration of HK$0.89 billion. -

The Group disposed of Huangshan Project in Mainland China.

The Group disposed of Huangshan Project in Mainland China. -

The Group disposed of the China mixed-used project, Kaifeng Nova City, at a consideration of HK$0.9 billion.

The Group disposed of the China mixed-used project, Kaifeng Nova City, at a consideration of HK$0.9 billion. -

The Group disposed of Dah Sing Financial Center in Hong Kong to China Everbright Group (a Fortune Global 500 company) and China Everbright Limited ( stock code: 165) made a record-setting transaction for high quality offices with a significant consideration of HK$10.125 billion.

The Group disposed of Dah Sing Financial Center in Hong Kong to China Everbright Group (a Fortune Global 500 company) and China Everbright Limited ( stock code: 165) made a record-setting transaction for high quality offices with a significant consideration of HK$10.125 billion.

-

-20180213111438.jpg) The Group acquired the John Sinclair House in Edinburgh, Scotland, United Kingdom.

The Group acquired the John Sinclair House in Edinburgh, Scotland, United Kingdom. -

The Group disposed of the land at Fo Tan, Hong Kong at a consideration of HK$1.4 billion.

The Group disposed of the land at Fo Tan, Hong Kong at a consideration of HK$1.4 billion.

-

China Kaifeng Nova City’s pre-sale program was launched.

China Kaifeng Nova City’s pre-sale program was launched. -

-20180213111549.jpg) The Group acquired the remaining interest of Lizard Island Resort Hotel, Australia held by the other shareholder.

The Group acquired the remaining interest of Lizard Island Resort Hotel, Australia held by the other shareholder. -

-

The Group disposed the 50%-owned Leiyang project in Mainland China and the Christchurch project in New Zealand

The Group disposed the 50%-owned Leiyang project in Mainland China and the Christchurch project in New Zealand -

The Group disposed the commercial podium, all public car parking spaces and all the remaining residential units of The Forest Hills in Hong Kong

The Group disposed the commercial podium, all public car parking spaces and all the remaining residential units of The Forest Hills in Hong Kong

-

The Group disposed the remaining block of Kaikainui Block in New Zealand.

The Group disposed the remaining block of Kaikainui Block in New Zealand.

-

-

The Group disposed part of Kaikainui Block, Favona Land and whole of Man Street Carpark in New Zealand.

The Group disposed part of Kaikainui Block, Favona Land and whole of Man Street Carpark in New Zealand. -

The Group bought an additional piece of land in Longquanyi District, Chengdu, Sichuan Province, China. Together with the two land lots purchased last year, the total site area increases to 506,000 square metres. They will be developed into a large-scale residential and commercial project.

The Group bought an additional piece of land in Longquanyi District, Chengdu, Sichuan Province, China. Together with the two land lots purchased last year, the total site area increases to 506,000 square metres. They will be developed into a large-scale residential and commercial project.

-

The Group’s large-scale residential and retail development project at Fo Tan, Hong Kong was approved by the Appeal Committee of Town Planning Board.

The Group’s large-scale residential and retail development project at Fo Tan, Hong Kong was approved by the Appeal Committee of Town Planning Board. -

Two pieces of land with a total site area of about 288,000 square metres were acquired in Longquanyi District, Chengdu, Sichuan Province, China and will be developed into a large-scale residential and commercial project.

Two pieces of land with a total site area of about 288,000 square metres were acquired in Longquanyi District, Chengdu, Sichuan Province, China and will be developed into a large-scale residential and commercial project. -

The Group acquired certain pieces of land in Kaifeng, Henan Province, China with a total site area of 735,000 square metres and it is proposed to be developed into an comprehensive project with large-scale luxury residential and commercial buildings and hotels.

The Group acquired certain pieces of land in Kaifeng, Henan Province, China with a total site area of 735,000 square metres and it is proposed to be developed into an comprehensive project with large-scale luxury residential and commercial buildings and hotels. -

The first batch of units for Phase 1 of The Redbud City, located in Leiyang City, Hunan Province, China was completed and delivered.

The first batch of units for Phase 1 of The Redbud City, located in Leiyang City, Hunan Province, China was completed and delivered.

-

.jpg) The grand opening of the Group's 5-star hotel Crowne Plaza Hong Kong Causeway Bay.

The grand opening of the Group's 5-star hotel Crowne Plaza Hong Kong Causeway Bay. -

-

The Group disposed a number of non-core investment properties (including 28 floor, No.9 Queen's Road, Central and G/F-2/F and signage space of the Morrison and the shop of Excelsior Plaza) and changed its investment proportion and focused on property development in Mainland China.

The Group disposed a number of non-core investment properties (including 28 floor, No.9 Queen's Road, Central and G/F-2/F and signage space of the Morrison and the shop of Excelsior Plaza) and changed its investment proportion and focused on property development in Mainland China. -

The Group completed the land acquisition in a famous scenic district in Huangshan City, Anhui Province of China for development project with leisure and tourist's facilities.

The Group completed the land acquisition in a famous scenic district in Huangshan City, Anhui Province of China for development project with leisure and tourist's facilities. -

Pre-sale of Phase 1 of The Redbud City, located in Leiyang City, Hunan Province of China was launched.

Pre-sale of Phase 1 of The Redbud City, located in Leiyang City, Hunan Province of China was launched.

-

The Group sold part of its shares in two Indonesian subsidiaries with assets comprised mainly of interests in various pieces of land situated in Indonesia.

The Group sold part of its shares in two Indonesian subsidiaries with assets comprised mainly of interests in various pieces of land situated in Indonesia. -

-

The Group's Wan Chai residential project in Hong Kong, "The Morrison" and the Diamond Hill residential project, "The Forest Hills" were ready for move-in.

The Group's Wan Chai residential project in Hong Kong, "The Morrison" and the Diamond Hill residential project, "The Forest Hills" were ready for move-in.

-

-

The sales of "The Morrison" in Wan Chai, Hong Kong and "The Forest Hills" in Diamond Hill, Hong Kong were launched with encouraging results.

The sales of "The Morrison" in Wan Chai, Hong Kong and "The Forest Hills" in Diamond Hill, Hong Kong were launched with encouraging results. -

Westmin Plaza (Phase 2), in Guangzhou, Guangdong Province of China, which includes residential units, office units and shopping mall, was completed.

Westmin Plaza (Phase 2), in Guangzhou, Guangdong Province of China, which includes residential units, office units and shopping mall, was completed. -

The Group privatised "Trans Tasman Properties Limited" by acquiring all remaining shares not owned by SEA Group.

-

SEA Group disposed of its shares in "UniMilo Knitwear Company Limited" and concentrated on property business.

-

SEA Group celebrated the 50th anniversary of its establishment.

-

SEA Group’s subsidiary company was listed on Alternative Investment Market (AIM) of London Stock Exchange.

SEA Group’s subsidiary company was listed on Alternative Investment Market (AIM) of London Stock Exchange. -

Pre-sale of "Westmin Plaza (Phase 2)", in Guangzhou, Guangdong Province of China, was well-received again with all units sold within 2 weeks.

Pre-sale of "Westmin Plaza (Phase 2)", in Guangzhou, Guangdong Province of China, was well-received again with all units sold within 2 weeks.

-

"Royal Green", a Hong Kong residential project developed jointly with Henderson Land Development Company Limited launched sale with very enthusiastic response.

"Royal Green", a Hong Kong residential project developed jointly with Henderson Land Development Company Limited launched sale with very enthusiastic response. -

"Plaza Central", an office & commercial property located in Chengdu, Sichuan Province of China was completed and became a landmark in the city.

"Plaza Central", an office & commercial property located in Chengdu, Sichuan Province of China was completed and became a landmark in the city. -

"Trans Tasman Properties Limited" moved its head office to Singapore while remaining listed on the New Zealand Stock Exchange.

-

The Group developed the new head office of Air New Zealand in Auckland.

The Group developed the new head office of Air New Zealand in Auckland.

-

Mr. Jesse Lu became the Chairman of the Group.

-

"New Century Plaza", located in Chengdu, Sichuan Province of China, was completed.

"New Century Plaza", located in Chengdu, Sichuan Province of China, was completed. -

"Trans Tasman Properties Limited" privatized its listed Australian property subsidiary "Australian Growth Properties Limited", and restructured its investment portfolio in Australia and New Zealand and increased its investment in the property market of Asia Pacific. The Australia and New Zealand properties were sold in view of the upcoming downside market and a few development sites in Hong Kong were acquired at favourable prices.

-

363 George Street, a premium grade asset in Sydney, Australia, was sold for AUD$397 million.

363 George Street, a premium grade asset in Sydney, Australia, was sold for AUD$397 million.

-

The residential units of "Westmin Plaza" (Phase 1), in Guangzhou, Guangdong Province of China, was completed and ready for move-in.

The residential units of "Westmin Plaza" (Phase 1), in Guangzhou, Guangdong Province of China, was completed and ready for move-in.

-

Pre-sale of Westmin Plaza (Phase 1), in Guangzhou, Guangdong Province of China commenced and achieved, successful results.

Pre-sale of Westmin Plaza (Phase 1), in Guangzhou, Guangdong Province of China commenced and achieved, successful results.

-

363 George Street, the Group’s flagship property in Sydney, Australia, was completed.

363 George Street, the Group’s flagship property in Sydney, Australia, was completed.

-

.jpg) The present Chief Executive Mr. Lambert Lu joined the Group.

The present Chief Executive Mr. Lambert Lu joined the Group.

-

The Group acquired 46.3% stake in the "Global Property Fund", and later took over the management of the Fund.

-

"Trans Tasman Properties Limited" spun off its Australian property arm, "Australian Growth Properties Limited", for a separate listing on the Australian Stock Exchange on 18 May 1997.

"Trans Tasman Properties Limited" spun off its Australian property arm, "Australian Growth Properties Limited", for a separate listing on the Australian Stock Exchange on 18 May 1997.

-

"SEABIL New Zealand Limited" was merged with "Tasman Properties Limited" (formerly called "Robt. Jones Investments Limited") to form "Trans Tasman Properties Limited" (TTPL). TTPL continued to be listed on the New Zealand stock exchange, and became the flagship property investment arm of the Group in Australia and New Zealand.

-

Listing of "SEABIL New Zealand Limited" (SEABIL) on the New Zealand Stock Exchange on 30th of June 1994.

Listing of "SEABIL New Zealand Limited" (SEABIL) on the New Zealand Stock Exchange on 30th of June 1994.

-

The Group acquired a controlling stake in "Unison Knitting Factory Limited" (HKSE code 272) and expanded into garment manufacturing and trading.

-

The office building at 108 Gloucester Road, Wanchai, Hong Kong, now known as "Everbright Centre", was completed. It housed the headquarters of the SEA Group.

The office building at 108 Gloucester Road, Wanchai, Hong Kong, now known as "Everbright Centre", was completed. It housed the headquarters of the SEA Group. -

Construction of the joint development property Gardenview Heights at 19 Tai Hang Drive, Hong Kong was completed in 1991 and the residential units were quickly sold out.

-

The Group entered into property development projects and cement production business in Mainland China.

-

The Group formed joint venture with Brierley Investment Limited to form SEABIL Pacific Limited, a property investment company in New Zealand.

-

A joint venture was set up for property development in Jakarta, Indonesia.

-

Relocated domicile to Bermuda with the incorporation of SEA Holdings Limited.

Relocated domicile to Bermuda with the incorporation of SEA Holdings Limited.

-

Expanded into the international market and invested in Discovery, a property project in Vancouver, Canada.

Expanded into the international market and invested in Discovery, a property project in Vancouver, Canada.

-

The Company acquired a number of prime land lots in Hong Kong and undertook a hotel development project.

-

The Group completed the development of an up-market 33-storey residential building, Amber Garden on Kennedy Road, Wanchai, Hong Kong.

The Group completed the development of an up-market 33-storey residential building, Amber Garden on Kennedy Road, Wanchai, Hong Kong.

-

The Company acquired a substantial stake of over 30% in the listed "Safety Godown Company, Limited" (stock code: 237) in 1974 for investment purposes.

The Company acquired a substantial stake of over 30% in the listed "Safety Godown Company, Limited" (stock code: 237) in 1974 for investment purposes.

-

The Company was listed on both the Far East and Kam Ngan Stock Exchanges in Hong Kong in 5 October 1973.

The Company was listed on both the Far East and Kam Ngan Stock Exchanges in Hong Kong in 5 October 1973.

-

.jpg) Mr. Jesse Lu, the present Chairman, joined the Company.

Mr. Jesse Lu, the present Chairman, joined the Company.

-

The Company expanded into property developments which included commercial, industrial and residential. It also invested in warehousing and textile industries, comprising spinning and weaving.

The Company expanded into property developments which included commercial, industrial and residential. It also invested in warehousing and textile industries, comprising spinning and weaving.

-

The Company was established in Hong Kong on 6th December, 1956 with an initial capital of HK$1 million by Hong Kong entrepreneur Mr. Lu Chu Mang, his brothers and fellow Indonesian Chinese friends in Hong Kong.

The Company was established in Hong Kong on 6th December, 1956 with an initial capital of HK$1 million by Hong Kong entrepreneur Mr. Lu Chu Mang, his brothers and fellow Indonesian Chinese friends in Hong Kong. -

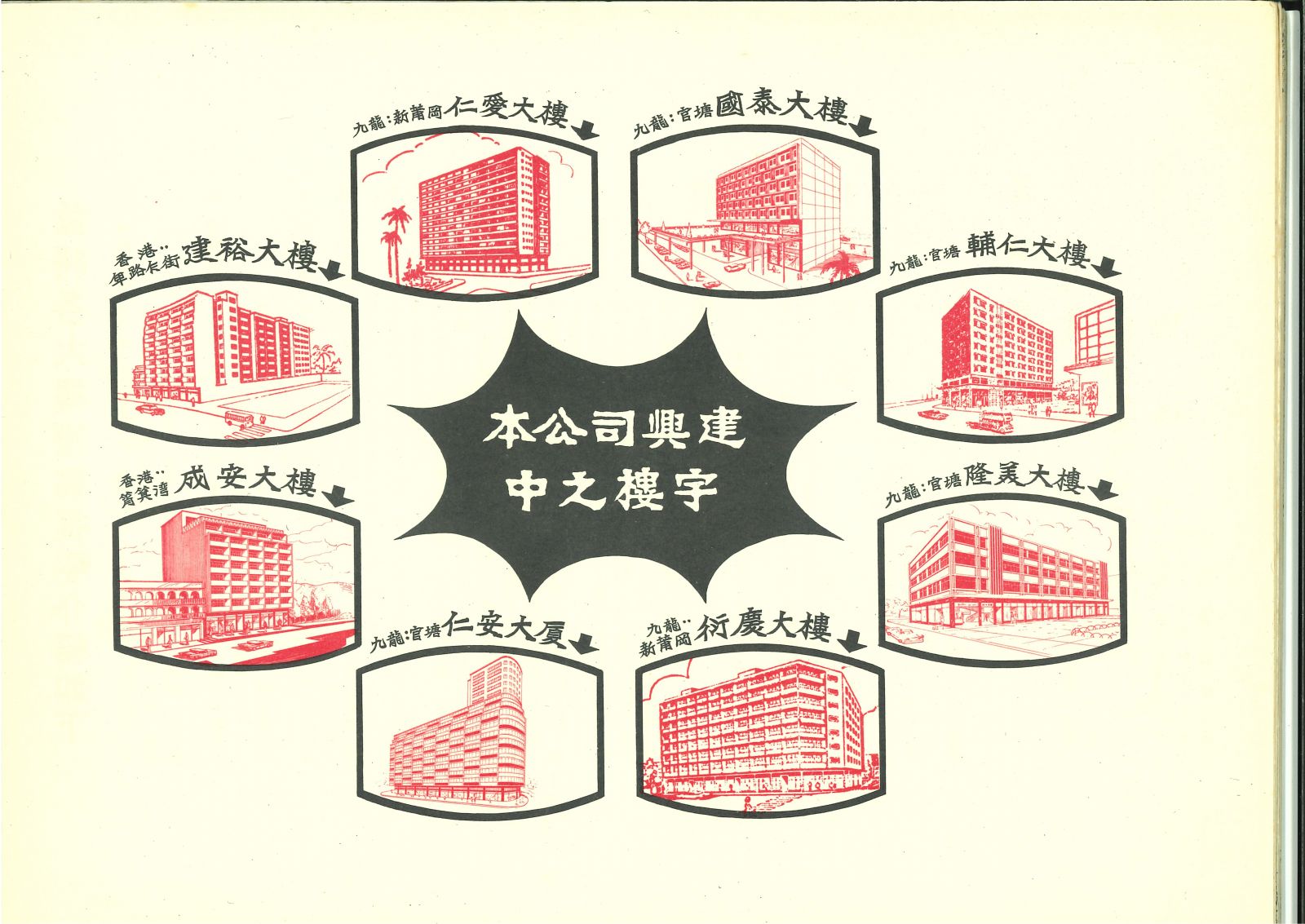

With its major business in property development, SEA was one of the pioneers in the development of the new industrial districts of Kwun Tong and San Po Kong.

With its major business in property development, SEA was one of the pioneers in the development of the new industrial districts of Kwun Tong and San Po Kong.

.JPG)

.JPG)